When MEDA received a federal grant in December 2012 to start a Promise Neighborhood at a quartet of low-performing schools in San Francisco’s Mission District, the four-decades-old agency remained at the vanguard of nonprofit best practices by implementing a comprehensive service integration strategy, whereby the families of students are offered free asset-building services. The aim is that every family succeeds and every student achieves, as these two outcomes are intricately linked. Staff know that the stressors of a family in economic distress create obstacles to a student’s academic success.

When MEDA received a federal grant in December 2012 to start a Promise Neighborhood at a quartet of low-performing schools in San Francisco’s Mission District, the four-decades-old agency remained at the vanguard of nonprofit best practices by implementing a comprehensive service integration strategy, whereby the families of students are offered free asset-building services. The aim is that every family succeeds and every student achieves, as these two outcomes are intricately linked. Staff know that the stressors of a family in economic distress create obstacles to a student’s academic success.

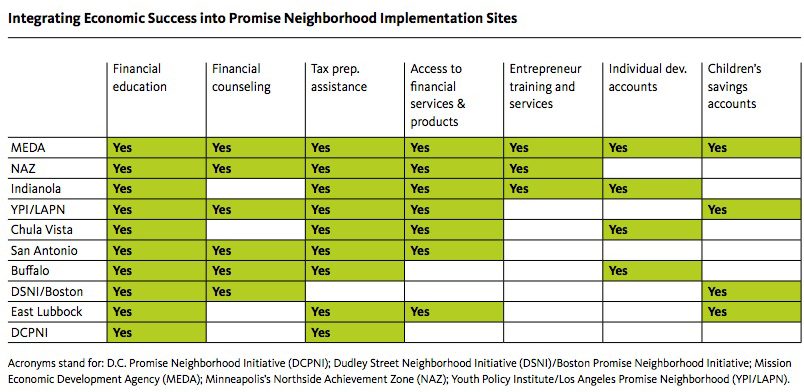

MEDA is proud to announce that its Mission Promise Neighborhood efforts have been recognized as part of a just-released, 50-page guide from PolicyLink, the Oakland-based, national research and action institute advancing economic and social equity. Entitled Integrating Family Financial Security into Promise Neighborhoods: A Resource and Implementation Guide, this influential work “aims to describe the programs, policies and practices that set families on a path to financial security while achieving prescribed Promise Neighborhoods results.” This guide is part of the Growing Assets Program—generously funded by The Citi Foundation—with the goal of incorporating essential asset-building strategies into the network of Promise Neighborhoods across the nation.

The Citi Foundation offers the needed support so that myriad programs can allow community partners to test, deliver and scale innovative approaches to asset building. These programs are designed to provide consumers with the tools and support they need to achieve their fiscal goals, morphing financial ken into efficacious action. Financial coaching and counseling programs abet consumers to implement financial plans, make payments, increase their savings, reduce debt and build their credit.

The report was co-authored by Alexandra Bastien and Solana Rice. Bastien, the current program associate at PolicyLink, conducts research on policy solutions to address the racial wealth gap and maintains a compendium of resources on strategies to achieve financial security for all. Rice was an associate director for over five years at PolicyLink, where she directed research on asset building and other strategies focused on enhancing economic security in financially challenged communities, particularly communities of color.

Bastien explains the guide’s purpose as follows: “There is substantial research that shows that low-income families can save. Savings and assets are the tools that allow families to withstand financial crisis and invest in their future. In addition, children with a savings account in their own name are 2.5 times more likely to enroll in college than children with no account.”

Pages 30-34 of the guide showcase the case study of MEDA’s best practices relating to the nonprofit’s innovative service integration model that aims to create assets for its low-income, mostly Latino families, who are often immigrants. The guide advises that this insightful case study should serve as an example other Promise Neighborhoods should follow.

One powerful quote from the MEDA case study claims: “Bringing financial education ‘in-house’ to select schools and hubs is filling a significant gap in clients’ knowledge and services. This approach of ‘meeting people where they are’ is proving to be a valuable one and is facilitating MEDA’s entry into new areas of the community and the recruitment of families into the MPN pipeline.“

To start sharing this report’s important data, MEDA’s Director of Asset Building Programs, Christi Baker, has been tasked with leading a presentation on this PolicyLink guide at the Promise Neighborhoods National Network Conference, being held this week in Arlington, Virginia.

Also, PolicyLink will be conducting a Webinar July 10th at 11am PT, with information in the guidebook being delved into further. Check back for details.

Leave a Reply