EITC: those four letters sure mean much to the low-income community of the Mission Promise Neighborhood. The term is so powerful that there’s even a day named for it. That would be “Earned Income Tax Credit Awareness Day,” which is today.

“Earned Income Tax Credit Awareness Day” is the brainchild of the IRS and is a federal strategy to foster a national grassroots movement to ensure those most in need know that EITC is a major tool for asset building.

The background

Enacted in 1975, there have been four legislative expansions of the EITC. In this time of bipartisan strife on the Hill, it is interesting to note that those on both sides of the aisle have championed this safety net that rewards work. Take the fact that three decades ago President Reagan, a conservative, actually proposed an expansion of EITC, knowing its value.

A Center on Budget and Policy Priorities October 2015 report, “EITC and Child Tax Credit Promote Work, Reduce Poverty, and Support Children’s Development, Research Finds” showcased the impact of the EITC.

The study claimed: “These working-family tax credits lifted 9.4 million people out of poverty in 2013, including 5 million children, and made 22 million other people less poor. And by encouraging work, the EITC and CTC have an additional anti-poverty effect not counted in these figures.”

The report also provided data on how the following items had been positively impacted, and are vital to our Mission Promise Neighborhood families:

- Improved infant and maternal health

- Better school performance

- Greater college enrollment

- Increased work and earnings in the next generation

- Social Security retirement benefits

U.S. Census data from 2014 show a $75,604 median household income in San Francisco. Conversely, our Mission Promise Neighborhood survey conducted in the same year concluded that 76 percent of respondents in that community made under $35,000 per year, with 90 percent making under $50,000 per year. Most of these families would qualify for the EITC.

The maximum amount of EITC this year is:

- $6,269 (three or more qualifying children)

- $5,572 (two qualifying children)

- $3,373 (one qualifying child)

- $506 (no qualifying children)

On a statewide level, California now offers Cal EITC, starting with the 2015 filing year. While the income levels for eligibility are much lower than the federal income levels, those who do qualify can possibly get another $2,653 added to their refund.

To meet local need, San Francisco now offers a Working Families Credit, whereby qualifying low-income families can earn a one-time only additional credit of $100 if paid via a paper check or $250 if paid by direct deposit. The program was designed to encourage families to avoid check-cashing fees by opening bank accounts, which MEDA can do for clients who do not have one. MEDA advises all clients to apply, even if they are unsure if they qualify for this credit.

MEDA’s free tax preparation grows

MEDA, the lead agency of the Mission Promise Neighborhood, runs what is now the largest free tax preparation program in San Francisco, with clients seen at Plaza Adelante and three other Volunteer Income Tax Assistance (VITA) sites in the city that the nonprofit oversees.

It’s interesting to note the history of VITA. Back in 1970, Gary Iskowitz was doing graduate work and teaching tax law at Cal State–Northridge, while also working for a tax agency. Iskowitz saw a growing problem with questionable tax preparers scamming low-income people, so he approached the dean at Cal State–Northridge with a plan to give him 10 students to whom he would teach a 24-hour class in tax preparation, at no cost to the university. In return, Iskowitz asked the university to nullify the students’ tuition for the class, as they became volunteers doing free tax returns for low-income community members. People lined up around the block waiting for this free tax preparation service.

Iskowitz’ idea became the success story for what had started in 1969 as a small federal program of the IRS. Decades on, millions now receive free tax prep from volunteers nationwide, with sites ranging from nonprofit social services centers, such as MEDA’s Plaza Adelante in the Mission, to military bases.

At MEDA’s four VITA sites, Tax Program Manager Max Moy-Borgen sees his team of staff and volunteers harness the power of the EITC every day.

Moy-Borgen explains, “With some of our Mission Promise Neighborhood families eligible for over $6,000 from the federal EITC, this is a major percentage of their annual household income. The EITC is a game changer when it comes to family economic success for the low-income community, especially when now supplemented by the new California and San Francisco tax-credit programs.”

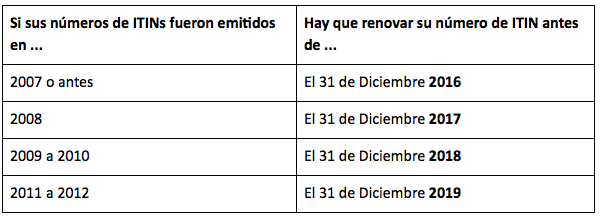

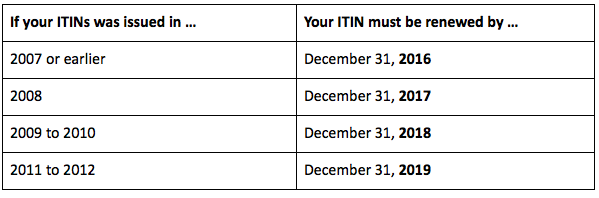

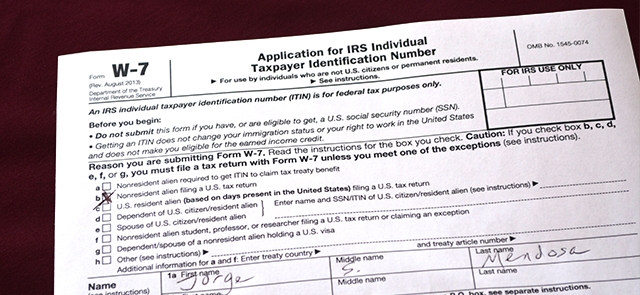

Moy-Borgen also sees the gaps for Mission Promise Neighborhood families. For example, undocumented Individual Taxpayer Identification Number (ITIN) holders are not eligible for such credits. The same goes for cash-income only clients with regards to the Cal EITC only; furthermore; most of the credit usually goes to reduce the client’s self-employment tax burden. For the San Francisco Working Families Credit, you do not qualify without at least one eligible dependent child on your federal income tax return. This combination makes it difficult for some low-income, single clients without dependents to make ends meet, as the income limit and credit amount is significantly reduced without children.

Regardless of their situation, Moy-Borgen’s team is well versed in all IRS situations that pertain to the low-income community, making sure maximum refunds are obtained for Mission Promise Neighborhood clients. This led to over $4.5 million being returned to the community last year … with 2016 looking equally impactful.

Are you a Mission Promise Neighborhood ready to get your EITC tax credits? Call (415) 282-3334 ext. 178 for your appointment for free tax prep in San Francisco.

Special thanks to the City and County of San Francisco-Human Services Agency, United Way of the Bay Area and Bank of the West for helping low-income residents do their taxes at no cost.

____________________________________________________________

About Mission Promise Neighborhood

The Mission Promise Neighborhood is a citywide community partnership that was created to support kids and families living, working, and attending school in the Mission District. It brings together schools, colleges, community organizations and community leaders to help kids graduate and families achieve financial stability.