MEDA Tax Program Manager Max Moy-Borgen received some exciting news when contacted by the Internal Revenue Service (IRS) last December. It turns out that MEDA had been chosen for an innovative Individual Taxpayer Identification Number (ITIN) pilot program – just one of three sites in the nation selected. MEDA is the lead agency of the Mission Promise Neighborhood.

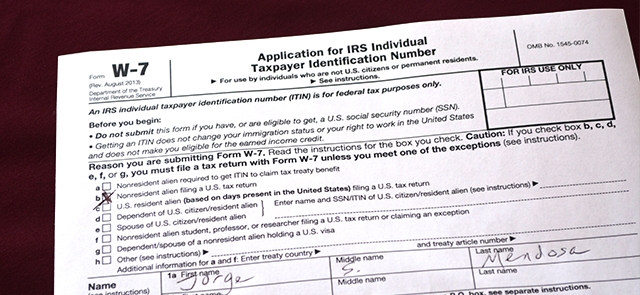

A nine-digit ITIN is a tax-processing number issued by the IRS so that people working in the U.S. can file a federal tax return without a Social Security Number.

Moy-Borgen knew that his years of building four culturally competent Volunteer Income Tax Assistance (VITA) sites in San Francisco had led to this honor, with free tax prep for Mission Promise Neighborhood families a big part of the services offered.

The gist of the pilot program is that MEDA’s status as a Certified Acceptance Agent (CAA) for the IRS has been expanded. This means that whereas before a dependent’s original passport or National ID Card would need to be mailed to the IRS with an ITIN application, photocopies of either of these documents will now be accepted. Before this pilot program, photocopies sufficed solely for primary and secondary taxpayers.

The genesis of this prospective streamlined process is based on the IRS having confidence in MEDA’s best practices around free tax preparation in San Francisco. This includes ITIN preparation, for which MEDA annually assists about 200 clients.

ITIN clients will benefit in two ways:

- They will now negate the risk of losing their dependents’ original documents – a nightmare situation for anyone. Moy-Borgen has seen such unfortunate incidents in the past, with the IRS claiming they never received a client’s original passport or National ID Card.

- What is currently a three- to four-month process will now be expedited. The reason is that just one point of contact, a supervisor in the IRS’s Austin, Texas office will be receiving the ITIN applications from MEDA, offering priority to these color-coded applications coming from the organization. Think of it as direct service rather than the possibility of getting lost in a bureaucratic maze.

It’s not surprising that the IRS is looking to streamline its ITIN-application process after two decades of the program’s existence. According to the IRS, in 2010 over 3 million federal tax returns were submitted using ITINs, with those filers paying $870 million in federal income taxes — a direct benefit to the federal coffers.

Explains Moy-Borgen of the need, “We explain to our undocumented Mission Promise Neighborhood clients that ITINs are a path to citizenship, acting as a way to prove that they have been living and working the U.S. ITINs are a means to eventually obtaining a Social Security Number, and no longer being off the radar.”

ITINs can also be used in other ways. Under the U.S. Patriot Act, provisions mandate that financial institutions collect information on their customers’ identities, and an ITIN suffices to open interest-bearing accounts. Also, an ITIN holder can secure a driver’s license in some states. Additionally, an ITIN can be used to establish or improve credit through MEDA’s Secured Credit Card with Self-Help Bank, with financial institutions even starting to use ITIN’s as a way to open credit cards, loans and mortgages.

Moy-Borgen is hoping that with the anticipated success of this pilot program, expansion to VITA sites nationwide will occur next year.

He concludes, “MEDA is honored to be part of this ITIN pilot program and looks forward to working with IRS officials to further the needs of our undocumented clients.”

Are you a Mission Promise Neighborhood family ready to get your ITIN or taxes prepared? Call (415) 282-3334 ext. 178 for your appointment for free tax prep in San Francisco.

Special thanks to the City and County of San Francisco-Human Services Agency, United Way of the Bay Area and Bank of the West for helping low-income residents do their taxes at no cost.

____________________________________________________________

About Mission Promise Neighborhood

The Mission Promise Neighborhood is a citywide community partnership that was created to support kids and families living, working, and attending school in the Mission District. It brings together schools, colleges, community organizations and community leaders to help kids graduate and families achieve financial stability.